FS 5336 2007 free printable template

Show details

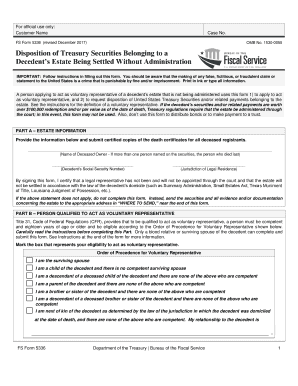

RESET For official use only: Customer Name PD F 5336 E Department of the Treasury Bureau of the Public Debt (Revised February 2007) Customer No. DISPOSITION OF TREASURY SECURITIES BELONGING TO A DECEDENT'S

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign FS 5336

Edit your FS 5336 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FS 5336 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FS 5336 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FS 5336. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FS 5336 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FS 5336

How to fill out FS 5336

01

Obtain the FS 5336 form from the appropriate government website or office.

02

Read the instructions provided on the form carefully.

03

Fill in the personal information section with your name, address, and contact details.

04

Provide the specific information requested regarding the purpose of the application.

05

Double-check all filled information for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate department by mail or electronically, as directed.

Who needs FS 5336?

01

Individuals or organizations that need to apply for certain federal benefits or services.

02

Government agencies requiring data for administrative purposes.

03

Anyone needing to update their personal information in federal records.

Fill

form

: Try Risk Free

People Also Ask about

What is a FS form 5336?

Document Type. Form FS Form 5336. Disposition of Securities Belonging to a Decedent's Estate Being Settled Without Administration. Form and Instruction. FS Form 5336 Application for Disposition of Treasury Securities Belon.

What happens when you inherit savings bonds?

If a surviving co-owner or beneficiary is named on the savings bond, the bond goes directly to that person. It does not become part of the estate of the person who died.

How can I avoid paying taxes on matured savings bonds?

Use the Education Exclusion With that in mind, you have one option for avoiding taxes on savings bonds: the education exclusion. You can skip paying taxes on interest earned with Series EE and Series I savings bonds if you're using the money to pay for qualified higher education costs.

How do I avoid tax on inherited savings bonds?

How to Avoid Paying Taxes on Savings Bonds. The IRS lets you avoid paying taxes on interest earned by Series EE and Series I savings bonds when you redeem them if you use the money toward qualified higher education costs for yourself, your spouse, or any of your dependents.

Do I pay taxes on inherited U.S. Savings Bonds?

The short answer is yes, you generally will be responsible for taxes owed on savings bonds you inherit from someone else. The good news is that you may be able to defer taxes on inherited savings bonds or avoid it altogether in certain situations.

How do I cash a deceased person's savings bond?

Get a certified copy of the death certificate for everyone who has died who is named on any of the bonds. Have each person who is entitled to a distributed bond also fill out and sign the appropriate forms: If they want cash for their bond: FS Form 1522. If it is an EE or I bond and they want to keep it: FS Form 4000.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in FS 5336?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your FS 5336 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit FS 5336 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing FS 5336 right away.

Can I edit FS 5336 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share FS 5336 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is FS 5336?

FS 5336 is a form used by organizations to report information related to financial transactions or specific activities as required by regulatory bodies.

Who is required to file FS 5336?

Organizations and entities that engage in particular financial activities or transactions as designated by the governing regulations are required to file FS 5336.

How to fill out FS 5336?

To fill out FS 5336, individuals or organizations should gather the necessary information, complete all sections of the form accurately, and submit it according to the outlined instructions and deadlines.

What is the purpose of FS 5336?

The purpose of FS 5336 is to ensure compliance with financial reporting regulations and to provide transparency regarding specific financial activities.

What information must be reported on FS 5336?

The information that must be reported on FS 5336 typically includes financial transactions, identified parties involved, dates of transactions, and any other relevant financial data as required by the regulatory framework.

Fill out your FS 5336 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FS 5336 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.